"Money is the most egalitarian force in society. It confers power on whoever holds it" ~ Roger Starr

Dear Patrons, the week gone by, was an eventful week. We had the expiry of the February contract in the derivatives market and the Railway Budget on the same day. This week was very volatile, with Nifty marking big swing downwards. Nifty started the week around 7200, made high of 7252 and then slid to 6961 losing all the gains made in previous week.

Next week starts with a BIG event for the markets, as we have The Budget on Monday. As we head into the Budget, we would like to advice caution and avoid leveraged positions till the event is over.

Technically, Nifty is in the process of forming a bottom. Should 6950 hold on Nifty, we may see 7350 in a hurry, on breaching 6950, however we may see the previous low breached.

Today, that is on 26 February, the GoI published the Economic Survey. The readings from the Economic Survey paints a rosy picture about the Indian Economy, which, we have been saying for long through this blog. We have always maintained that small steps taken by the GoI will result in large impact on the Economy, and we have been validated by the Economic Survey.

Let us look at some data points.

1. Fiscal Deficit: In the last Budget the target for Fiscal Deficit was fixed at 3.9% of GDP and the Government has largely managed to keep it in check.

2. Inflation: Inflation has by and large remained in check, mainly due to decrease in Crude prices and high interest rates. Looking at the inflation data, we feel RBI has room to cut rates further and boost the economic activity

3. IIP: IIP has been on a steady path of growth and with increased impetus on Make in India, we should see better industrial activity in future

4. GDP: India is the only shining star in the globe in the current recessionary scenario in the developed world. We expect to grow by 7.5% next year, which is a fabulous growth, in the bleak global outlook

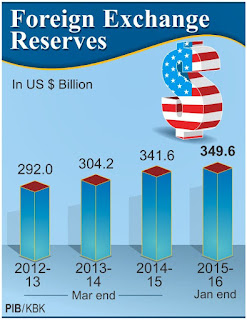

5. Forex: There has been steady growth in Forex Reserve, though not satisfactory, it has increased. We should see more money coming in India over next year, which in turn should help the INR gain some lost ground

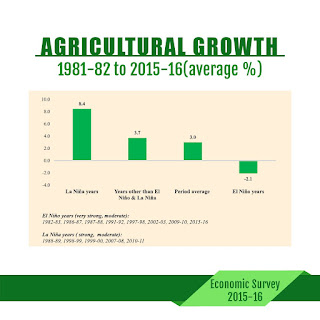

6. Agricultural Activity should see major thrust in this Budget, as we are reeling from 2 years of drought. 2016 however promises to be good as far as monsoon is concerned as the El-Nino effect is not present in this year.

All in all we expect a good Budget, with significant allocation for Agri sector as well as Industry. Our motto remains the same. Accumulate good quality stocks.

Stay Invested!!